A state is an institution that claims a monopoly to the legitimate use of power in a given territory. As such, states use their coercive power to shape our lives in ways the government prefers. That is, state actions force some of us to live according to the values of those in government.

As individuals, when we act poorly, or pursue our selfish interests, the consequences of our human failings are limited to our private sphere; but our undesirable human traits do not disappear when we serve in government. Politicians do not change their nature when they enter public service. What changes is that the constraints that have limited their actions to the private sphere are suddenly removed.

This yields an understanding that bad governance is not necessarily a result of having the wrong people in office. Governance reflects our humanity. Our human failings, when combined with the coercive force of government, can be damaging to freedom. Consider the forewarning of economist Thomas Sowell: “The first lesson of economics is scarcity: there is never enough of anything to fully satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.”

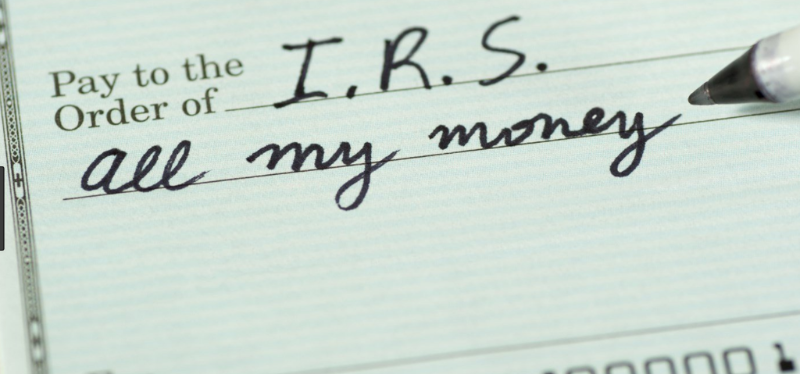

In our Jeffersonian conception of government, governments exist to secure our rights. Thus, we allow government the power to tax us to pay for the costs of protecting our rights and to have an orderly society. But, the Founding Fathers specifically rejected the concept of taxing income in favor of less morally offensive ways of funding government. For example, I favor taxing consumption rather than income.

A progressive income tax unfairly treats the citizenry differently on the basis of their income. To the Founders, progressive income taxation was a violation of the moral principle that all men are created equal and must be treated equally under the law.

Taxing income violates the Kantian ethical formulation that humans should never be treated merely as a means to an end, but always as end in themselves. When citizens do not break laws, but the state takes away from them simply because they have acquired more than others, the power of the state is immorally used. In economic terms, this is a misdistribution from the most productive citizens to the less productive ones. Also, a progressive tax with different rates for different incomes promotes class warfare and allows the government to pry intrusively into the affairs of the citizenry in order to asses the tax.

The United States government managed to fund its operations quite well without an income tax for 126 years until the 16th Amendment was ratified in 1913 permitting a progressive income tax. The principle of progressive taxation- the more one earns, the larger the percentage of tax penalty one must pay- would have been horrifying to the Founders. As would have been the idea that Congress would tax one group of citizens to bestow benefits on another group. The 16thAmendment overturned the Founder’s philosophies of uniform taxation and equal protection of the law for all citizens.

To the reader that may find harsh my characterization of taxing income as immoral, consider the view expressed in Congress during the 1913 tax debate by William Shelton from Georgia. The then proposed tax for married couples would only apply on income over $4,000. Mr. Shelton argued that he supported the income tax “because none of us here have $4,000 incomes, and somebody else will have to pay the tax.” In other words, as George Bernard Shaw put it: “Those who rob Peter to pay Paul can always count on the support of Paul.

As to Plato’s argument of the dangerousness of poets: Let’s repeal the 16th amendment!

Please let us know if you  this article. this article. |

|

No comments:

Post a Comment